Even More POS Features

One of the greatest advantages of getting a cutting-edge POS system like this is that you can build the one that you need for your specific business.

You won�t be forced to buy some full standard package that comes with all kinds of hardware and services that you won�t even use, but instead, you simply select the devices that you need and only add the apps you�re going to use. Once you�re up and running, which won�t take long, you can manage every aspect of the system and do it from anywhere.

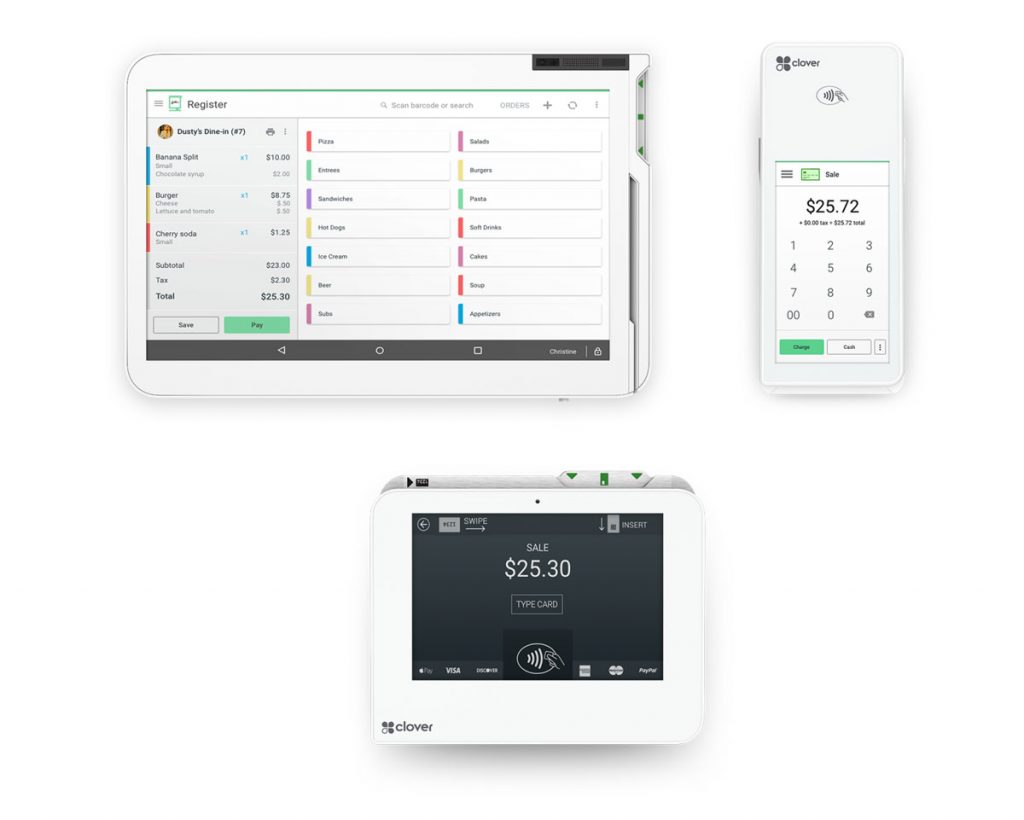

Managing Orders

To manage your orders, just bring up the dashboard on any of your devices. Whatever you decide to offer for your customers, you can set up for in-store, pickup, or deliver orders and monitor them all in real time, as well as review them later at any time.

For restaurants, track all your tables and tabs, manage open and closed orders, split up orders easily, or combine orders as needed.

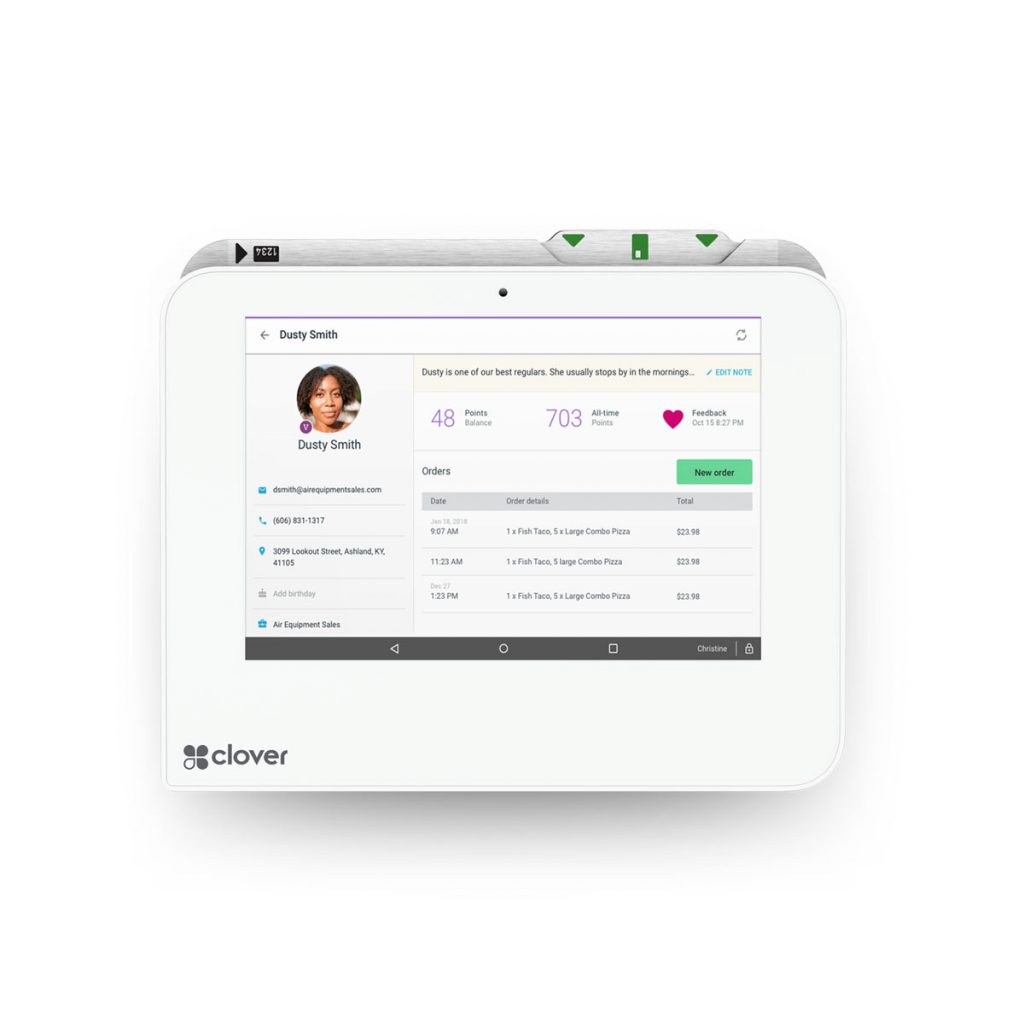

Maintain relationships with your customers

One unique feature that can be extremely useful is the ability to create personalized profiles for customers, so that you can use that information whenever you interact with them to show that they�re important to you. You can add things like birthdays, purchase history, phone numbers, and email addresses.

Set up loyalty and rewards programs, too, to encourage repeat business. You don�t need to be pushy about it of course, but once you have some unique information about each customer, you can send out occasional promotional materials to them, or even just wish them a happy birthday in an email.

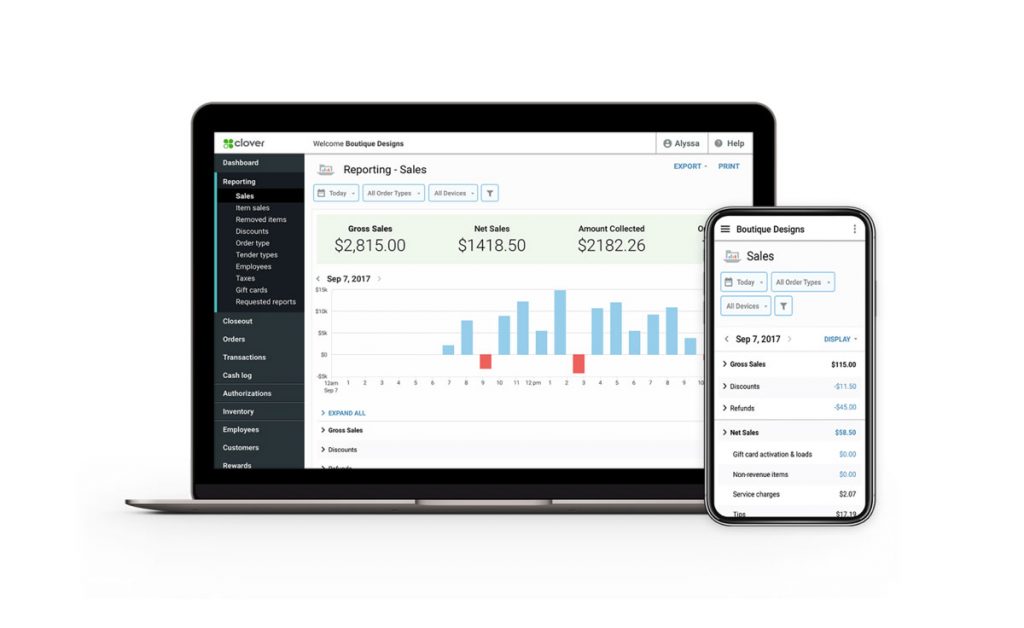

The same POS can be used for managing staff

Employee shifts and schedules can be organized and viewed via the POS. Administrators can also set up users and permissions for each employee to segregate access and functionality for them as needed.

When you get everybody in the system, admins can then track activity for employees, including things like daily sales, tips, refunds, and other items.